Recommendations for processing credit card purchases

Overview

The following guide outlines the recommended procedure for processing credit card transactions in Accentis Enterprise. This is a guide only – you may have your own methods and procedures for processing credit card transactions.

Important concepts

Let’s start with some important concepts that are often overlooked when dealing with credit cards:

A Credit Card statement is just another bank statement

A common mistake people make is to treat credit card purchases differently from other purchases where you pay the supplier directly. When you receive your bank statement, you will look at payments made and reconcile that with payments in Accentis Enterprise (which in turn will relate to supplier invoices).

The Credit Card company is not the supplier of goods or services purchased

When you buy petrol from a petrol station, the supplier is the petrol station, not your credit card provider (e.g. VISA, MasterCard). The Credit Card is simply a means of paying your bill. This is the most important concept to understand because it will allow you to ensure consistency in data entry for supplier purchases, whether you pay for them via credit card, cash, direct debit or EFT transfer.

Setting up your system

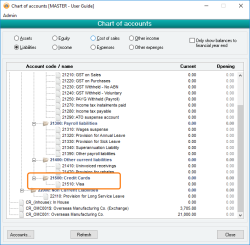

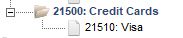

- The recommended approach is to ensure that a general ledger account that represents your credit card exists – just like your bank accounts. Many people will allocate this under liabilities, just like a loan account.

- If you have multiple credit cards, it is a good idea to have general ledger account for each card. That will enable you to isolate purchases and reconcile them separately.

Entering Supplier invoices into your system

When you receive your credit card statement (or at any other time you like), you should enter Supplier invoice s representing the purchases made on that card – just as you would if you received an invoice in the mail. The person who made that purchase should have retained the original invoice or receipt.

Use the correct supplier wherever possible so that you have a good record of purchases from that supplier. If you don’t want to create a supplier for each type of purchase, make use of a CASH or SUNDRY supplier code. For example, you wouldn’t create a supplier code for every petrol station! Using suppliers like this when you intend to pay the bill immediately is okay.

Paying your supplier invoices using the credit card account

Each time you enter a supplier invoice that was paid with the credit card, you can press CTRL-P after updating to go straight to a payment. Select your credit card account as the Drawing account and update. Your credit card general ledger account will now increase in value (increase your debt). Once all invoices have been paid in this way, the total list of payments for the period will reconcile to the total of transactions on the credit card.

Don’t forget to enter bank fees or late payment fees as well.

Paying off your credit card

To pay off your credit card, you can do this in one transaction using a Manual Payment:

- Go to Accounts Payable > Payment.

- Click New and tick “Manual” at the top.

- Select your normal bank account as the Drawing account.

- At the bottom, the Allocation account will be your credit card general ledger account.

Once you update, this will bring your credit card general ledger balance back down again.

Reconciling your credit card

Your credit card accounts should be reconciled just as you would a bank account. You can use the Account reconciliation function in Accentis Enterprise to reconcile your credit card statement. Don't worry, if you need to, you're able to undo an account reconciliation - How to Undo an Account reconciliation

Don’t forget – important notes and tips

- Whoever made purchases on the credit card must keep their tax receipt or tax invoice.

- The credit card institution is not your supplier, it is just a bank account, so treat your credit card statement just like a bank statement.

- Invoices entered for purchases on your credit card should be entered against a real supplier or a SUNDRY or CASH supplier, not VISA or MCARD suppliers (because they supply financial services, not the goods bought on the credit card).

Last edit 11/10/19