How to process receipts from EFT facilities that deduct a fee from the settlement

It can be common for EFT payment facilities such as Square, PayPal and others to deduct a fee for their services from the total sales of the day before processing the funds to your bank. When this happens, if you haven't accounted for it correctly, the figures won't balance in Accentis Enterprise because the values will be different. The solution to this is to create a payment to the EFT facility for the amount that was deducted as fees after entering the total value of sales. This then becomes your daily settlement fee which, when deducted from your daily sales total for the EFT facility, will now reconcile with the amount deposited into your bank by the EFT facility.

Steps to process

- Process sales as usual but ensure that all receipts post their values to a cash on hand or EFT clearing account

- At the end of the day, perform a Deposit transaction in Accentis

- This will take all EFT receipts performed that day for your EFT facility and transfer it as a lump sum into your bank account (called a settlement)

- Add a Manual Payment type for the value of the fees

- Accounts payable > Payment. Ensure it is a Manual payment and allocate the fees to an appropriate expense account

- The total value of this payment will be equal to the fees that were charged by your EFT facility

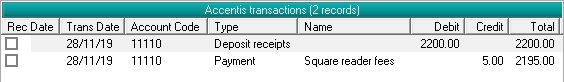

Account reconciliation

When you perform an Account reconciliation, you will now match off the two transactions above with the single deposit that was made into your bank account by the EFT facility

Did you find this article helpful?

If this article is missing information, ambiguous or didn’t give you clear instructions, let us know and we will make it better! Please email us and quote the KB# in the top left of this article to let us know why it didn’t help you out and we will point you in the direction of additional information.

Last edit 27/11/19