How to make a supplier prepayment that includes GST

Overview

Sometimes suppliers will issue a tax invoice for prepayments, in which case it is not sufficient use the “unallocated payment” method of paying a supplier in advance for goods. To correctly account for a supplier prepayment prior to receiving your goods, the process is as follows.

This will be a non-stock item code, named appropriately e.g. "PPSUPPLIER". The exact code that you choose will depend on your current item code formats.

- It will have a GST tax code

- It should be a non-stock item

- The unit of measure will be $ (if you don't have this unit of measure, use F12 to add one)

- Link the item to a warehouse by going to the Warehouses tab and adding the warehouse

- On the Accounts tab, allocate the Expenses account as your supplier prepayments General Ledger account

- Add the deposit item to the end of the Purchase Order

- Quantity: 0 (this is important, because you are not actually ordering a prepayment from the supplier)

- Amount: The amount of your pre-payment excluding GST

- Add appropriate comments to explain what you have done and why

- Note the total value of the Purchase Order still has not changed. This is important.

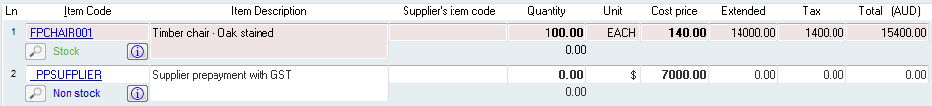

Here is an example of how it might look on the Purchase Order:

The next step is to actually pay the prepayment to the supplier, as follows:

- Create a receive for the prepayment item code. When you do this, you will need to click on the Show all lines so that the item shows up (because it is not technically on backorder, so it won't show up by itself).

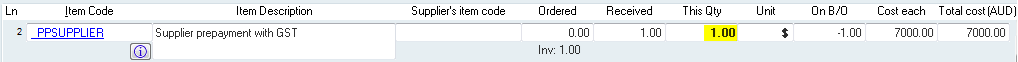

Here is how the Receive record will look:

- Create an invoice for the Receive record using a quantity of 1 for the prepayment. The total value will be your prepayment amount (which may include GST depending on how you have chosen to set it up).

Here's how the invoice will look:

- Pay the invoice as you would a normal invoice.

Note: The ex Tax prepayment amount will now be sitting in your General Ledger account and the GST amount will be appearing in your GST credits account.

When the goods arrive, you should also receive an invoice with the value of the goods less your prepayment amount. This will be processed as follows:

- Receive the goods and also receive a quantity of -1 of the prepayment. This will generate your credit amount. You are effectively telling Accentis Enterprise that you have no longer received the prepayment item and the net quantity received will be back to zero.

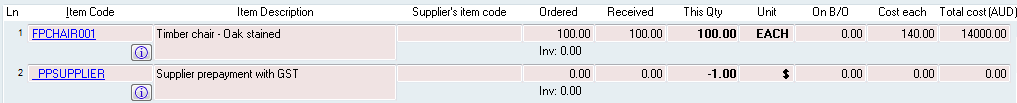

Here is an example of how it will look:

- Invoice the receive as you would normally. The total value will be the value of the goods less your prepayment.

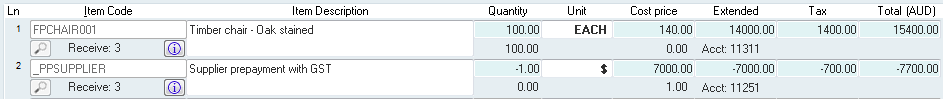

Here's an example of how it will look:

- Update and pay the balance

Alternate process

You don't need to create the prepayment item code. Instead, you can use the direct account code entry feature (start with a full stop in the item code field then use a General Ledger account).

Did you find this article helpful?

If this article is missing information, ambiguous or didn’t give you clear instructions, let us know and we will make it better! Please email us and quote the KB# in the top left of this article to let us know why it didn’t help you out and we will point you in the direction of additional information.

Last edit: 09/09/20