Processing Superannuation in Accentis Enterprise

This page describes how to process Superannuation payments in Accentis Enterprise.

For any special processes regarding Superannuation in Accentis Enterprise, please see the Superannuation How To Guides.

Contents

Overview

Superannuation is money paid by employers to employees to provide for their retirement. Superannuation is calculated as a percentage of an employee’s Ordinary Time Earnings (OTE) income. This amount is then paid to an employee’s Superannuation fund through a Super clearing house.

Process

Superannuation is processed in Accentis Enterprise using the below method.

1. Perform preliminary checks

- Check that all pay runs have been completed for the period and there are no adjustments needed.

- Report SA1186 will show an Alert for any pay runs that are unapplied in the period.

- You can also use report SA1186 to check the correct Superannuation has been calculated for the period you are processing. This report has the following columns you can use to check everything is correct:

| Column name | Description |

| SGC OTE | This column shows the Ordinary Times Earnings for the employee based on the setup of the pay items. This column is grey as it is based on calculations, not transactions. |

| SGC Rate | This is the Superannuation Guarantee rate the employee is currently set to in their employee file. This column is grey as it uses the current rate set for the employee. This may not have been the rate set at the time the pay run was processed. |

| SGC Calc | This column is only a calculation on this report and equals SGC OTE amount multiplied by the SGC Rate. This column is grey as it is based on calculations, not transactions. |

| SGC Paid | This is the Superannuation Guarantee amount that has been calculated and included (paid) in the pay runs for the period. |

| SGC Paid +/- | This shows the difference between the amount processed through the pay run and the amount calculated on the report. This column may have small amounts (0.01) which would be caused by rounding, any other amounts should be investigated. Some causes of differences could be: |

| • Changes to a pay item that ticked or unticked the “Calculate employer SG superannuation on this pay item” after a pay run has been processed. | |

| • Manual adjustments to the Superannuation in the pay run. | |

| Sup Add | This shows Employer additional amounts paid in the pay runs. |

| SUP S+A | The total of the SGC paid and Sup Add columns. |

| Sup emp | This is the amount of any employee additional superannuation entered as a deduction after tax and is generally not reportable through STP but paid to the Super clearing house with the other Superannuation payments. |

| Sup SS | This shows the total of any Salary Sacrifice Super amounts included in the pay runs for the period. |

| Sup Total | The sum of the SGC Paid, Sup Add, Sup emp, and Sup SS columns. |

| Sup reportable | This is the total of reportable Superannuation amounts excluding SGC Paid. |

2. Export report and upload to Super Clearing House

Once you are sure the Superannuation amounts are correct, the next step is to download the report to upload/enter into your Super clearing house.

- Go to Payroll > Reports > Special Reports and select the Superannuation report for your Super clearing house.

- Enter the From and To dates of the period you are lodging.

- Click Refresh and the report should populate with the details for the period.

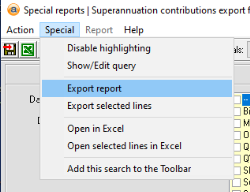

- To export the report for upload to your Super clearing house – Go to the Special menu and select Export report.

- Enter the details to save the report and change the Save as type to the file type required by your Super clearing house.

- This could be Raw Text, CSV, or Excel.

- Upload the report or manually enter the details (if import is not supported) into your Super clearing house.

3. Pay the Super Clearing House

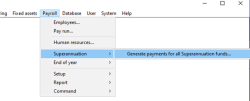

- Go to Payroll > Superannuation > Generate payments for all Superannuation funds

- Enter the Start date for the period and click OK.

- Enter the End date for the period and click OK.

- This will create the Superannuation payment. If you have entered the Super clearing house for each of your Superannuation funds in the Supplier code, there should only be one payment created.

- Adjust the Date to the date you will make the payment.

- Make any other adjustments required, then Update and Close.

- If you have multiple Suppliers codes entered or you do not have a Supplier code entered for any Superannuation funds, a new payment will be created for each additional Supplier code/Superannuation Fund.

- Once all payments have been created you will receive a message saying, “Superannuation payments successfully generated for the period XXXX – XXXX”.

- The payments will now be available to add to an ABA file for upload into your bank account for payment.

Additional Notes

Having all your Superannuation funds set to the same Super clearing house Supplier code will make the process faster and reconciling your payments to your bank statements easier. When a Supplier code is added to the Superannuation funds one single payment will be created for all Superannuation funds linked to the Supplier.

Process

- Create a Supplier for the Super clearing house if you don’t have one already.

- Add the Super clearing house supplier to all Superannuation funds.

- To do this go to:

- Payroll > Setup > Superannuation funds and enter the Super clearing house Supplier code in the Supplier code (for payments) field.

- To do this go to:

Frequently Asked Questions

Can multiple superannuation funds be set up for an employee?

No, there is currently only the ability to add 1 Superannuation fund per employee. If, as an employer, you have agreed to pay the employee's Superannuation into multiple Superannuation accounts, this would need to be manually adjusted in the Super clearing house.

What happens if amounts are refunded from the Super clearing house?

If you process superannuation for an employee and the money gets returned from the Super clearing house, please see KB432 – How to process a Payment returned from a Superannuation Clearing House.

Last edit 14/02/24