How to set up Accentis for Paid Parental Leave (PPL)

Paid parental leave (PPL) is when the government pays one of your employees while they are on parental leave for a certain period. These payments are made through you as the employer. The government pays you and you pay the employee.

Setting up PPL in Accentis involves creating a PPL pay item specifically for this purpose, so that you can track the payments you have made and the reimbursements you have received. The net result is that there will be no additional expense to the business. The G/L account to which the pay item posts is often a clearing account instead of a wages expense account.

Setting it up

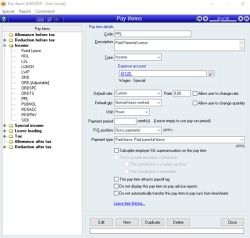

Create a new pay item for PPL if one does not already exist.

- Code: PPL (or similar)

- Type: Income

- Link to the required account - either a wages expense or, more commonly, a clearing account into which your PPL reimbursements are receipted from the government

- Default rate: Custom

- Rate: Set this to the current rate set by Services Australia

- Default Qty: Custom

- Qty: 1.00

- Unit Type: Each

- Payment type: Paid leave: Paid parental leave

The important points to note are:

- The PPL expense account should be an account of your choosing – either a wages expense account or, more commonly, a clearing account into which your PPL reimbursements are receipted from the government. The end result for this account will be zero.

- There is usually no superannuation or payroll tax on PPL (check with your relevant state or federal legislation)

Using the PPL pay item

Use the PPL pay item for an employee in the same way you would use any other pay item. Add the PPL pay item to the pay run or the employee’s card (if you always want it to appear on a pay run until you untick it)

- Check at the end of each month that your PPL clearing account is zero (or that you can account for its balance)

- The payments IN that you receive from the government should equal the payments OUT for your payroll system

- If you have any questions about when, why or for whom you should use PPL, please review the relevant government web site

Did you find this article helpful?

If this article is missing information, ambiguous or didn’t give you clear instructions, let us know and we will make it better! Please email us and quote the KB# in the top left of this article to let us know why it didn’t help you out and we will point you in the direction of additional information.

Last edit 23/12/21