How to process a novated lease

This article is not a substitute for professional accounting advice and is intended as a guide to the set-up of a novated lease in Accentis Enterprise. You should ensure that you are getting the end results that you need from both a payroll and financial viewpoint.

A novated lease is a three way financial agreement between an employer, employee, and financier. As an employer, you will be responsible for paying the lease agreement through a combination of pre-tax and post-tax salary deductions. In most cases, the novated lease company will supply the details and amounts for you to pay. If no details are supplied, you will need to speak to your accountant.

An employee enters into a three-way written agreement with the lease provider and the employer. They receive the benefit of reduced taxable income and pays costs exclusive of GST.

The lease provider supplies the employer with the figures for payroll processing and handles the administration of the agreement.

Every pay period, pre-tax and post-tax deductions are made on the employee’s pay. The employer pays the vehicle expenses from these deductions and claims the GST. In most cases, this will be a regular payment to the lease company for the same amount. The lease company will then handle the disbursements, however this is not always the case.

You should speak to your tax agent for advice on any Fringe Benefit Tax (FBT) implications.

- Set up a liability account – Novated Lease Payable (generally this account would be placed under Payroll Liabilities header account)

- Set up a liability account – FBT Payable (if required) (generally this account would be placed under Payroll Liabilities header account)

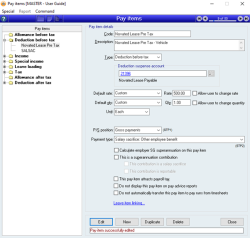

- Set up a pay item for the pre-tax salary sacrifice portion – as below:

- Code - Novated Lease Pre-Tax

- Type - Deduction before tax

- Link to new liability account Novated Lease Payable

- Default Rate - Custom

- Rate is the “Before Tax Deduction” amount supplied by the novated lease company or your tax agent

- Default qty – Custom

- Qty - 1

- Unit – Each

- Payment type - Salary Sacrifice: Other employee benefit

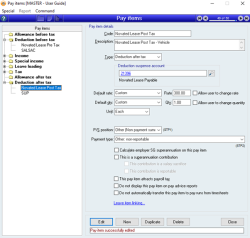

- Set up a pay item for the post-tax salary sacrifice portion – as below:

- Code - Novated Lease Post-Tax

- Type - Deduction after tax

- Link to new liability account Novated Lease Payable

- Default Rate - Custom

- Rate is the “After Tax Deduction” amount supplied by the novated lease company or your tax agent

- Default qty – Custom

- Qty - 1

- Unit – Each

- Payment type - Other: non-reportable

- Set up a pay item deduction category – Employee Contribution FBT. Link to new liability account FBT Payable (if required)

- In the employee's file, add the pay items and tick them to add to the pay run by default

- Create a new Supplier for the lease company

- Create a supplier invoice for the first payment to the lease company

- Create a supplier invoice using the general ledger account you created as the item code (add . then the code or . and press F3 to find the account)

- Enter the correct amounts including the GST

- Then Update

- Once the invoice has been updated you go to the special menu at the top of the form and click on Recurring info

- Enter the details for the recurring Supplier Invoice

- When you receive the next invoice or the next payment is due, you can go to Accounts payable > Process recurring payables and select the Novated lease and process selected. This will enter a new invoice ready for you to pay.

The GST component will be added to the GST paid account and will not be removed from the liability account. GST is treated as a separate component in transactions.

If you have multiple employees with novated leases, it is recommended that you set up separate accounts for each novated lease. This will make it easier to balance and reconcile the account. Using the employee’s name in the account name is a good way to differentiate the accounts (e.g. Novated Lease Payable – Jane Smith, Novated Lease Pre-Tax – Jane Smith and Novated Lease Post-Tax – Jane Smith).

The provision of a vehicle by way of the novated lease is considered to be a car fringe benefit to the employee. An employee post-tax contribution is considered GST inclusive income (or negative expense) and reduces the FBT value attributable to the provision of the car and hence reduces the FBT liability. Most novated lease companies will calculate the post-tax contribution so no FBT is payable, however this is not always the case. You should always check with your tax agent.

Did you find this article helpful?

If this article is missing information, ambiguous or didn’t give you clear instructions, let us know and we will make it better! Please email us and quote the KB# in the top left of this article to let us know why it didn’t help you out and we will point you in the direction of additional information.

Last edit 23/12/21