What to do if I have overpaid an employee

This article is not a substitute for professional payroll advice and is intended as a guide to the set-up and processing of an overpayment repayment agreement between an employer and an employee in Accentis Enterprise.

Overview

Sometimes when you overpay staff you need to get the money back. However, in most cases it is unlawful to deduct money from the employee’s next pay. Below is the set-up procedure for recovery of overpayments when a repayment agreement between Employer and Employee has been entered into. The below steps can also be used to correct the tax, superannuation and leave balances if applicable.

Some awards do allow for the deduction of wages to repay overpayments, but this is not generally the case. You should always check your award or agreement to determine what is the correct solution for your situation.

How to

- Create a loan account in your Chart of Accounts for the employee

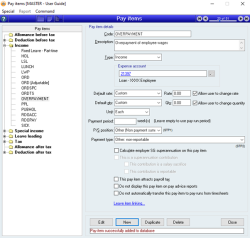

- Create new Pay items (e.g. OverPayment):

- Set the expense account to the loan account you have set up

- Default rate: Custom

- Default qty: Custom

- Unit: Each

- Payment type (STP2): Other: non-reportable

- Create an adjustment Pay run for the employee you have overpaid. When you have finished the pay run, the amount of the pay should be zero.

- Set the date of the pay run to be the date of their last pay cycle — this will allow your next pay run to proceed without issue

- Set the Pay from date and Pay to date to be the same dates as the pay run with the overpayment and ignore any warnings

- Remove any unnecessary Pay items

- Add the pay items that were overpaid if not already listed. If the pay items that were overpaid are not adjustable you will need to use an adjustable pay item. If you don’t have one set up already you will need to create a new pay item that is adjustable by ticking the Allow user to change quantity box (remember to link this pay item to any required leave items).

- Add the new pay item "OverPayment" that you created — enter the agreed amount to be repaid

- Add a pay item called "EXTRA TAX" — you will need to calculate the difference between the tax that should have been paid and the tax that was paid. Add the difference to the EXTRA TAX pay item (this would normally be a negative figure to reverse the overpayment of tax).

- If Superannuation was calculated on the overpayment and an adjustment is needed — enter a negative amount of superannuation as required at the bottom right of the Pay run details screen. This will reverse any superannuation that should not have accrued.

- Click the leave tab to ensure any leave that was Accrued on the overpayment has been reversed (if required)

- Update, apply the pay run and lodge STP. You should now see the agreed amount for the employee to repay in the loan account.

- When a repayment is made, apply the payment to the loan account.

Q&A

There are rules around what can lawfully be deducted from an employee pay. Please see the Fairwork website with details on deductions and overpayments.

This is more complex and advice should be sought from a payroll expert before proceeding. If you are unable to process the overpayment using the method above, please contact Accentis Support with the figures and outcome required and we will help you set up and process the pay run.

Did you find this article helpful?

If this article is missing information, ambiguous or didn’t give you clear instructions, let us know and we will make it better! Please email us and quote the KB# in the top left of this article to let us know why it didn’t help you out and we will point you in the direction of additional information.

Last edit: 23/12/21