How to set up for Paid Family and Domestic Violence Leave

This information is accurate as at February 2024. However when dealing with rates, limits, exclusions or dates, you should always check with the relevant authorities that these values are current.

Overview

Employees may be able to access a specified number of days of paid family and domestic violence leave. This type of leave works as follows:

- The full 10-day entitlement is to be available to employees up front but does not accrue each year if unused

- Each anniversary for an employee, they again have access to a full 10 days of leave

- Any remaining leave for the prior period is not added on to this: the leave is reset to 10 days on each anniversary

- Once the leave is exhausted, there is no more leave available until their next anniversary date

- Leave is not pro-rated for part-time or casual employees.

The new leave entitlement will be available to employees from

- 1st February 2023 for employees of non-small business employers

- 1st August 2023 for employees of small business employers

Warning: There are rules around the details of this leave item showing on the employees’ pay advice. The details below are the current requirements at the time this article was published. Please check the www.fairwork.gov.au website for the most up to date requirements.

Process

The pay item code and description must not make any reference that it is payment for Family and Domestic Violence Leave. Fair Work Australia have suggested that the pay item make no reference to leave being taken, and instead be shown as Ordinary hours of work or another kind of payment such as an allowance, bonus or overtime payment.

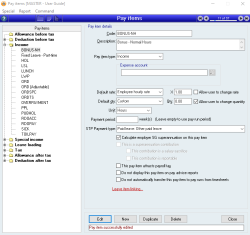

For the purpose of this example we will call the pay item BONUS-NH.

- Code: BONUS-NH

- Description: Bonus - Normal Hours

- Type: Income

- Default rate: Employee hourly rate

- X: 1.00

- Default qty: Custom

- Qty: 0.00

- Tick “Allow user to change quantity”

- Unit: Hours

- Payment type: Paid leave: Other paid leave

- Tick “Calculate employer SG superannuation on this pay item”

- Click “Leave item linking” and tick AL, PL and LSL"

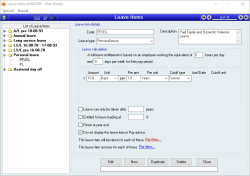

This can be added to an existing leave type (e.g. Personal leave) or you may wish to set up a new leave type, for the purpose of this example we are going to use the “Personal Leave” Leave type.

- Code: PFVDL or similar

- Leave type: Personal leave

- Leave calculation: 0 hours per day 0 days per week

- Amount: 10.0

- Unit: Days

- Per amt: 1.0

- Per Unit: Years

- Cutoff Type: Forever

- Tick the “Do not display this leave item in Pay advice”

- Click “This leave item will be taken for each of these Pay items” and select LEAVE – OTHER

- Click “This leave item accrues for each of these pay items” and make sure no pay items are selected (you can click “Clear all” to remove any ticks)

As the employee has access to 10 days leave up front and not accrued, this is added to the employee through an adjustment pay run. Once added it will be available for the employee to take as required. The leave can be added to all employees in the adjustment pay run or just added to individual employees as required.

- Add the Leave item to all employees

- To add the Leave item use command SA3449

- Select the PFVDL leave item and select all employees

- Click run

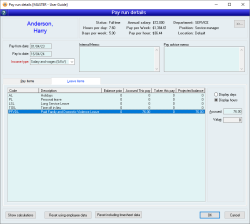

- Create a new Pay run

- Use the same Pay to date as the previous pay run, so as not to interfere with the next pay run.

- Remove all Pay items so the gross pay is $0

- Click on the Leave items tab in Pay run details

- Click on the PFVLD Leave item

- Enter the hours to make up 10 days in the Accrued box

- Full-time would be 76 or 80 depending on your standard work week

- Part-time would depend on the normal hours worked in a day if the employee normally works 5 hours in a day you would enter 50hrs

- Casuals get paid based on their rostered hours for the time taken, so could be different hours for each day taken, in the scenario, the hours taken could be added as need with a record of remaining days kept in the employee’s file.

- Add notes to the pay run

- Update and apply

- The number of hours will be added to their Balance

When an employee takes paid family and domestic violence leave this needs to be reflected in the pay run but can have no mention that this is the reason for the leave on the pay advice. Details can be added to the Internal Memo in the employees’ Pay run details and this will not show on the payslip.

When an employee takes paid family and domestic violence leave, add the BONUS-NH pay item to the pay run and enter the hours taken.

Note: There are rules regarding the details that can be shown on the employee’s payslip. The details above are correct as at the time this article was published. Please check the Fair Work Australia website for the most up to date requirements.

On the employee’s anniversary date, the paid family and domestic violence leave renews, and employees are entitled to a full 10 days from this date.

If the employee has not taken any paid family and domestic violence leave, then nothing will need to be done as they will still have the 10 days available. If however the employee has take some or all of the paid family and domestic violence leave, on their anniversary the amount will need to be topped up to the full 10 days.

You can use report SA4729 (CTRL-SHIFT-R) to check the amount that needs to be topped up for each employee. Once you have the amounts to be adjusted create a new adjustment pay run (Step 3 Part B) and enter the top up amount required for the employee.

Did you find this article helpful?

If this article is missing information, ambiguous or didn’t give you clear instructions, let us know and we will make it better! Please email us and quote the KB# in the top left of this article to let us know why it didn’t help you out and we will point you in the direction of additional information.

Last edit 13/02/24