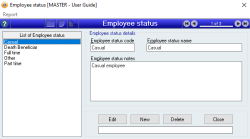

Employee status

Employee status allows you to classify employees according to the basis of their employment, primarily Full time, Part time or Casual. You are able to add you own Employee status values as needed to further classify the employment status of your employees.

- User-definable employee status so that you can reflect various industry awards, entitlements or agreements

- No practical limit to the number of different employee status that you can create

- Smart naming allows Accentis to detect correct status for STP2 compliance

Module: Payroll

Activation: Main > Payroll > Setup > Employee status

Special actions available for users with Administrator permissions:

- None

Database rules:

- None

Reference: text(16), mandatory, FlexiCode

This is the code given to a employee status to allow it to be quickly identified.

The Employee status code is a FlexiCode. This allows you to modify the Employee status code while still retaining all previous internal references and links to that Employee status.

Reference: text(64)

This is the basis in which the Employee is employed. An employee must have one of the following selected for submission through STP. If creating new employee status’s they must include the terms “Full time”, “Part time”, “Casual”, "Other" or “Death beneficiary” as part of the name. For example – if creating a new status for full time employees that work nights you would name the employee status “Night full time” or “Full time night”.

If “Full time”, “Part time”, “Casual” or “Death beneficiary” are not included as part of the description, the Employee status will report as “Other” and will only allow STP reporting of Superannuation figures. If any other reportable figures are included in the Pay run, it will create an STP error and not allow the STP to lodge.

Full time (F) – a person who is engaged for the full ordinary hours of work as agreed between the payer and the payee and/or set by an award, registered agreement or other engagement arrangement. A full-time payee has an expectation of continuity of the employment or engagement on either an ongoing or fixed term basis.

Part time (P) – a person who is engaged for less than the full ordinary hours of work, as agreed between the payer and the payee and/or set by an award, registered agreement or other engagement arrangement. A part time payee has an expectation of continuity of the employment or engagement on either an ongoing or fixed term basis.

Casual (C) – a person who does not have a firm commitment in advance from a payer about how long they will be employed or engaged, or for the days or hours they will work. A casual payee also does not commit to all work a payer may offer. A casual payee has no expectation of continuity of the employment or engagement.

Death beneficiary (D) – the recipient of an employment termination payment (ETP) death beneficiary payment who is either a dependant, non-dependant or trustee of the estate of the deceased payee.

Other (N) – would generally be used for contractor employees that only have a Superannuation STP reporting requirement. If Other is used, the employee will be considered a “Non-employee” for STP reporting and will only allow the reporting of Superannuation contributions. If any amount other than Superannuation is included in the employees’ pay, the STP will error and will not be lodged.

Reference: memo, expandable

This field should contain any comments that are relevant to the Employee status.

Last edit 21/04/23