How to process a Payment returned from a Superannuation Clearing House

Overview

Occasionally, you may have a Superannuation payment returned to you (in part or in full) after you have made the payment to a Superannuation Clearing House. This could be because the amount transferred did not match the amount submitted, or there may have been an issue with an individual employee's Superannuation fund.

Regardless of the reason for the returned payment, you will need to process it by adding the value of the returned Superannuation payment to the Superannuation Liability account and removing the amount paid from the employee. This process is outlined below.

Process

Identify the relevant employee

Firstly, you may need to identify the employee to whom the returned payment applies. This is because sometimes, Superannuation Clearing Houses do not provide the details of the employee to whom the payment relates, they just return an amount.

- Run report SA4264 and enter the period to which the returned Superannuation payment relates.

- This report will list all employees and the amount of Superannuation accrued for the period.

- Search through the report to find the employee with the corresponding Superannuation amount.

Create a negative payment for the returned Superannuation

- Go to Payroll > Superannuation > Generate payments for all Superannuation funds.

- Enter the Start date of the period of the returned Superannuation and click OK.

- Enter the End date of the period of the returned Superannuation and click OK.

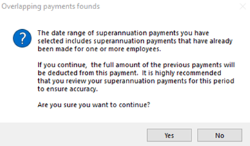

- You will get a warning stating that the Superannuation payments have already been made for one or more employees for this period. Click Yes.

- This will then display the Superannuation payment with all employees listed.

- Enter the amount of the returned payment from the Superannuation clearing house as a negative value and enter the date the payment was returned.

- Change the payment type to Direct.

- Find the employee on the list and enter the returned amount as a negative value for that employee.

- Update the payment.

- All the other employees should disappear and only the employee/s with the returned amounts will now be displayed.

- Close the payment.

Process the Superannuation payment again

Once you have identified the reason the payment was returned and resolved the issue, you will be ready to repay the amount to the Superannuation Clearing House.

- Begin to process the Superannuation for the period as you normally would.

- As you have already created a negative payment for the returned Superannuation, the employee/s in question will have the returned amount/s as an “outstanding” value against their name.

- All other employees will display a value of “0”.

- Continue processing the outstanding Superannuation payment as normal.

Did you find this article helpful?

If this article is missing information, ambiguous or didn’t give you clear instruction, let us know and we will make it better! Please email us and quote the KB# in the top left of this article to let us know why it didn’t help you out and we will point you in the direction of additional information.

Last edit 14/02/24