Processing your BAS in Accentis Enterprise

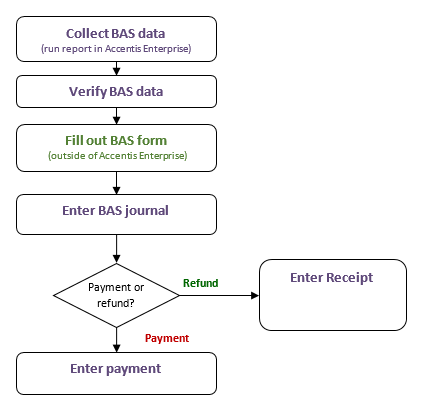

This article discusses the recommended approach for recording the transactions of your Business Activity Statement (BAS) in Accentis Enterprise and then processing your refund/payment from the ATO (Australian Taxation office).

These are recommendations only – there are many ways to record the transactions of your BAS. Furthermore, this article must not be used to determine what values or amounts should or should not be included on your BAS, only how to process the figures once you have determined their value using reports within Accentis Enterprise.

Your business activity statement summarises business activity for the Australian Taxation Office. This will usually consist of the following values:

- Amounts that you owe to the ATO for GST that have been collected from your sales invoice

- Amounts that the ATO owes you for the GST that you have paid on supplier invoices

- Amounts that you owe the ATO for income tax instalments

- Amounts that you owe the ATO for voluntary withholding, no ABN withholding or PAYG withholding

You may have to submit a BAS monthly, quarterly or annually and you will follow this procedure each time you fill out your BAS

It is recommended that you have your chart of accounts set up with at least the following accounts:

| GST Payable to ATO | All sales invoices will allocate the GST portion to this account |

| GST claimable from ATO | All supplier invoices will allocate the GST portion to this account |

| PAYG from payroll | Your payroll module will allocate PAYG amounts withheld to this account |

| No ABN withholding | If you make a payment for a supplier invoice that does not have an ABN specified, a portion of the payment will be withheld from the payment and automatically posted to this account |

| Voluntary withholding | If you make a payment for a supplier invoice for whom the supplier has requested that you withhold a certain amount, that amount will be withheld from the payment and automatically posted to this account |

| Income tax instalments paid | This account record income tax instalments paid and will be used when entering your BAS record into Accentis |

| ATO suspense account | This account represents your ATO account and is the amount payable or refundable by the ATO at any point in time. |

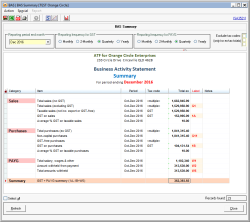

The first step, before entering the transactions into Accentis or filling out your BAS is to collect your BAS data. Accentis Enterprise has available a standard BAS Summary report for this purpose based on the transactions you have entered into Accentis Enterprise. You can locate this report under General ledger > Report > BAS > BAS Summary (SA3521) which will produce output similar to that shown below.

It is important to note that this report is for ACCRUALS only. Furthermore, the reports you use from Accentis Enterprise to gather BAS data must be taken in the context of your entire business, particularly if you have other BAS obligations such as PAYG income tax instalments or other amounts that are not included in this report.

After identifying and collecting BAS data, you should verify that the data is correct and accurate as much as possible. Hyperlinks on the totals shown on the BAS Summary report will drill down into the details transactions that make up each total and you should examine the detailed transactions for anomalies such as incorrect tax rates, improper dates or incorrect tax status of transactions. The data that is output on a report is only as good as the data that was entered by users, so checking is a very important step.

The next step in the process is to take the BAS data you have gathered and fill out your BAS either using a paper form supplied by the ATO or using the web portal online BAS entry service. Whichever method you choose, it is important to fill out and submit your BAS proceeding to the next step because the BAS entry and calculation process may yield additional amounts that are required to complete the processing in Accentis Enterprise (e.g. income tax instalment amounts).

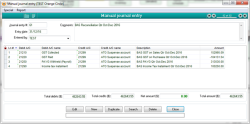

Once you have filled out your BAS and used either the ATO calculation sheet or the online BAS facility provided by the ATO, you will have a BAS summary listing various amounts and a total. This should be entered into Accentis Enterprise as a Manual Journal Entry as follows:

Pay special attention to the following:

- The date of your BAS should be the last day of the period to which the BAS applies, not the date you pay or intend to pay the debt. In an accruals system, this is very important so that you can reflect your reconciled liability as at the end of the reporting period regardless of when you decide to pay. It also allows you to make progress or partial payments off your debt without affecting the actual BAS reconciliation.

- The Debit account used should be the “control account” representing the relevant section in your G/L liabilities. Each account will be different and each account will represent a provision being accounted-for in your system

- The Credit account should be your ATO/BAS clearing account. The purpose of this journal is to clear out all BAS control accounts for the period and post the net balance into a single clearing account to be paid (or claimed) to the ATO. This is the same way the ATO will represent this set of transactions

- The amount entered should come directly from your BAS report providing you haven’t made any other manual adjustments or corrections since your last BAS. The exception is your GST Paid (credits): for consistency and ease of understanding, our recommended approach is to represent this as a negative number rather than swap the Debit/Credit account. By doing this, the total of the journal actually represents the net amount posted to the clearing account

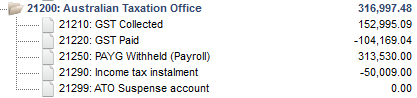

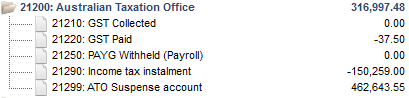

So once you have made the BAS journal entry, what does this mean for your chart of accounts? Let’s take a look at our chart of accounts before and after the BAS journal:

Before BAS journal

After BAS journal

You can see that the amount owed to the ATO hasn’t changed (it is still $316,997.48), however you will now see that the individual ATO accounts have been reduced according to the BAS amounts. The income tax instalment has increased, both the GST accounts and PAYG have decreased, and you now have an amount in the ATO Suspense account that needs to be paid to the ATO.

A common question that is asked is why the GST accounts do not go back to $0 after the BAS journal is done? The reason for this is that the balance left in those accounts is due to transactions that have been performed after the BAS reporting period. The BAS in this example was prepared in December, so the balances left in the GST accounts are for activity after the December period.

You will notice that after the BAS journal, the income tax instalments are negative. This is because they are posted to a liability account which, under normal circumstances, is the amount you owe to someone. Because you have pre-paid an amount of income tax into this account, it currently represents an amount of money that the ATO owes you. When your tax return is prepared, the amount of income tax you are required to pay for the financial year will be offset by these instalment amounts.

Most companies will be required to make a payment to the ATO. Once your BAS has been prepared, your payment to the ATO is then a very simple Manual Payment that comes from your bank account and is allocated to the ATO suspense account. Using the example above, here is our payment to the ATO for this BAS:

It is possible to make a payment for your BAS and allocate it directly to all of the ATO accounts, rather than journal to the ATO suspense account and then make a separate payment that posts back to this account. However, we recommend separating the transactions for the following reasons:

- This is the way the ATO will record it and it makes it easier to reconcile against their statements. The ATO will first record the balance of your BAS as a transaction against your account, and then separately record your payment of the outstanding amount against your account

- If you need to pay your BAS liability off in separate payments, this is now a very simple task that will no longer involve splitting between GST and other accounts.

- You can use the Accentis Account Reconciliation to reconcile your ATO suspense account with your ATO statement of account

If you are due to get a refund from the ATO after your BAS, the method shown above now makes it very easy to process it. Simple enter a Receipt using the ATO suspense account as the “Allocation account”. This will increase the ATO suspense account balance back to $0 and add money into your bank account. It is effectively the reverse of your payment if you owed the ATO any money.