Tax codes

A Tax code is assigned to every item to determine its treatment from a taxation perspective. Each item has exactly one Tax code, and the details of that tax code determine how much tax a customer pays when they are sold the item and how much tax should be paid when purchasing the item. In addition, a Tax code also determines which General ledger accounts are assigned the value of any tax on sales or purchases.

- No practical limit to the number of tax codes that can be created

- An unlimited number of Items can use the same Tax code

- Tax codes are FlexiCode

- You can specify that tax is already included in the cost of an item

- You can specify that the list price of an item already includes tax

Module: Inventory

Category: Tax codes

Activation: Main > Inventory > Setup > Tax codes

Form style: Multiple instance, SODA

Special actions available for users with Administrator permissions:

- Change the User ID of the Entered by field of memos.

- Edit memos entered by other users.

Database rules:

- You cannot delete a Tax code that is currently used by an item

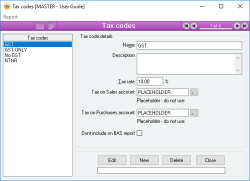

This is the complete list of all Tax codes currently defined. As you click on each item in the list, the details for the selected Tax code appear on the right.

When you want to edit or delete a Tax code, highlight the Tax code in the list and click on the Edit or Delete button.

Reference: text(20), mandatory, FlexiCode

This is the name given to the Tax code. The list of Tax codes from which you can select on the item form uses this name.

The Tax code name is a FlexiCode, which means that you can change the name of the Tax code but still retain all of the internal links to the original Tax code.

Reference: memo, expandable

This is a description of the Tax code and is used for reference purposes only while viewing the Tax code record on the Tax codes form.

Reference: quantity, mandatory

This the rate of tax which is applied to Items using this tax code when they are bought or sold. When an item using this Tax code is used on a Sales quotation, Sales order, Sales invoice, Purchase Order or Supplier invoice, the tax is calculated on the sell price using this rate.

Reference: account, mandatory, QuickList

When a Sales invoice is updated that contains an item using this Tax code, the tax portion of the Sales invoice line for that item is credited to this account.

To display the Chart of Accounts from which you can select an account, click on the button or press the QuickList Hot Key.

Reference: account, mandatory, QuickList

When a Supplier invoice is updated that contains an item using this Tax code, the tax portion of the Supplier invoice line for that item is debited to this account.

To display the Chart of Accounts from which you can select an account, click on the button or press the QuickList Hot Key.

Reference: yes/No

Information is under review for a new version and will be updated soon.