How to set up a Working Holiday Maker (WHM)

Overview

Working holiday makers are temporary visitors to Australia that require a special tax rate when employed to work. If a business is registered as an employer of working holiday makers with the ATO, then the working holiday maker tax rates should be used.

Process

- Import the Working Holiday Maker tax scale

- Contact Accentis Support for a copy if you don’t have one

- Go to Payroll > Setup > Tax scales > Click special menu at the top > Import tax scales

- Once updated you should see the Working Holiday Maker tax rates at the bottom

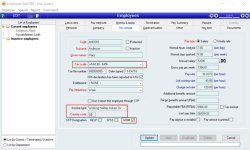

- Create the new employee

- Ensure the Working holiday maker box is ticked – this notifies the ATO the employee is a working holiday maker

- Ensure the correct tax scale is chosen – a working holiday maker will always start on the WHM $0- $45K tax scale. When the employee has reached $45,000 in earnings, you will need to manually adjust the tax scale in the employee file to the next one (WHM $45K - $135K).

- Select the Income type and enter the Country code - Working holiday makers use the employees home country code.

Additional Notes

The tax scales for working holiday makers are not automatic. When the employee has reached the top threshold of the current tax scale, the tax scale on the employee form will need to be manually adjusted to the next WHM tax scale. Regular checks should be done to ensure the employees earnings have not exceeded the threshold of the current tax scale.

Did you find this article helpful?

If this article is missing information, ambiguous or didn’t give you clear instruction, let us know and we will make it better! Please email us and quote the KB# in the top left of this article to let us know why it didn’t help you out and we will point you in the direction of additional information.

Last edit: 14/06/24