Single Touch Payroll FAQs

If you are on our Software Upgrade Program, our support team will be in contact with you to organise an upgrade. Customers who have elected to not join the upgrade program, you will need to contact Accentis directly to find out about our upgrade options.

Your transport provider charges by volume of data sent. If you continually resubmit pay runs to the ATO, you will be sending more data and can incur more costs. You will need to check with your transport provider on what they allow.

Yes. We manage all of the information and package it up but it needs to be securely transmitted to the ATO using an accredited STP transport provider. Accentis has created interfaces for the providers we believe provide a good service. You can contact support to find out who they are and how to subscribe to them, or view our guide on how to Setting up STP.

The ATO has made this change to allow for greater reporting capabilities to the ATO on employee payroll matters. It will save businesses the requirement of having to submit End of Year PAYG reports to the ATO, and allows employees better access to their payment summaries through the myGov platform.

Accentis server will hold any reports that it has not sent and will continue attempting to connect. Once a connection has been established, the reports will be sent automatically. You can configure in minutes how often Accentis Enterprise will poll when submitting reports to the ATO.

You can either:

- Add an adjustment pay run (recommended, especially if you have sent the bank data)

- Un-apply and Edit the existing pay run, fix and re-apply. You won’t be able to re-send this data to the ATO though – that will happen next time you communicate with the ATO through STP.

- Any corrections to payroll data where the payments made are not subject to withholding are not required to be reported.

- When you lodge your BAS, it may automatically be pre-filled with the original data (before your change) so you should ensure you lodge on your BAS the correct PAYG figures from Accentis, not the pre-filled figures.

This error occurs when you attempt to lodge the same pay run multiple times to the ATO within a 24-hour period.

A full file replacement can only be submitted once within a 24-hour period. You should wait 24 hours before attempting to submit the data again. If it fails again, please contact support.

That’s ok, just fix the employee information and re-send it. If you are going to do a pay run within the next 14 days then you can just let the information feed through on your next pay run.

If you have overpaid someone, we recommend performing an adjustment pay run. However, the YTD pay or withholding amounts in a financial year cannot be negative so if your adjustment will result in negative pay or PAYG withholding for the financial year, please contact the ATO for guidance.

Yes, you can start reporting at any time. However, you must be registered for PAYG before using STP.

If you used a previous system to report STP data, you can look at Choosing the process that best fits your situation.

Yes, Tax file number declarations can be performed as part of a single touch pay run lodgment. For more information, see the How to submit a Tax file number declaration guide.

Yes, you can find out more information on STP reports when you view SA4422 - STP Dashboard.

If an employee is required to sign a new TFN declaration, this can be reported via an STP lodgment by updating the Date signed field and un-ticking the TFN declaration has been reported to ATO option on the employee form. The next pay run that includes the employee and is lodged for STP will include the updated declaration.

See How to submit a Tax file number declaration for more details on how to complete the TFN declaration via STP.

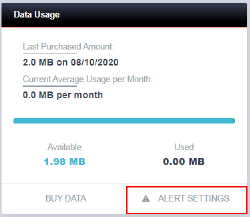

To make sure you get notified when your OzEDI data is running low, ensure that you have at least one of your Contacts set up to be a “Notification” type of contact, like this:

Once you have done that, then you can go to the Manage Service section and ensure that these contacts are notified by setting the low data notification limit in the Alert Settings:

Single Touch Payroll (STP) has changed how businesses report employees’ end of financial year (EOFY) information to both your employees and the ATO.

What you need to know

Because STP is sent to the ATO on each pay run, the process is much easier. Employees no longer need to be provided with a payment summary for payments made through STP. You are required to ‘finalise’ your employees’ EOFY payroll information through Accentis Enterprise by 14th July each year.

You are no longer required to lodge a payment summary annual report for the amounts reported through STP, as long as you complete the finalisation declaration by the finalisation date.

What you need to do

Employees need to be informed on the changes too. They need to be aware that:

- You will not be giving them a payment summary

- Their payment summary information is called an Income Statement in the ATO online in myGov

- They need to log into their myGov account > Select ATO online services > click on “my profile” > Select “my employment” > then “income statement” to access this information

- If they use a registered tax agent to lodge their income tax return, the agent will receive the income statement information directly from the ATO

- If they don’t have a myGov account or cannot access one, and don’t use a registered agent, they should call 13 28 61 and they will be able to get their information

If employees need any help creating or logging into their myGov account and linking to the ATO’s online services, they can easily get access to information at ato.gov.au/onlineservices.

- Fields affected by STP

- How does STP work in Accentis Enterprise

- How to setup MessageXchange as the STP Transport Provider

- How to setup Other (FILE) as the Transport Provider

- How to setup Ozedi as the STP Transport Provider

- More information & resources on STP

- SA4422 - STP Dashboard

- Setting up STP

- Single Touch Payroll – Your first Pay Run in Accentis

- Single Touch Payroll (STP)

- Single Touch Payroll FAQs

- STP Finalisation and Lodgment

- STP Phase 2 (STP2)