Keeping track of Un-invoiced Receives

What are “un-invoiced” receives

Un-invoiced receives represents all goods or services that you have received from Suppliers through Purchase order for which you have not yet received an invoice.

Each time you buy anything from a supplier, the goods or services you buy are received into stock or expensed and then you owe an amount of money equalling the cost of those goods. However, from an accounting perspective, until you receive the supplier’s invoice you don’t really owe that supplier any money – after all, there’s no invoice so there can be no debt. So who do you owe the money to? Under a double-entry accounting system, if the value of your stock or expenses has increased by receiving goods or services, there must be a liability (or debt) to pay someone for those goods or services somewhere.

The answer to this is the Accentis Enterprise un-invoiced receives General Ledger account. It is a single account that holds the value of all goods or services that have been supplied through purchase orders but not yet invoiced by your supplier. When you receive the invoice for these goods or services from the supplier, the value (cost) is transferred from un-invoiced receives to the actual supplier’s general ledger account.

Why can’t you just wait until you get the supplier’s invoice?

The question of why this is even necessary is often raised and the proposed solution of not updating any accounts for goods received until the invoice is entered. The flaw in this approach is that you may need to use and account for the costs of these items well before you receive the invoice.

For example, when you receive stock items to sell, they need to be entered into Accentis Enterprise with a cost before they can be sold, and to do this the value of your inventory must increase. If the value of your inventory increases, then the value of an opposite account must also increase.

Why not just update the supplier’s account when you receive the goods?

Another common question is why the supplier’s account can’t be updated with the value of the goods when they arrive and just do nothing when the invoice arrives? After all, you do really know who the supplier is, don’t you? The reason the supplier’s account is not updated when goods are received is because as far as the supplier and the accounting system is concerned, you don’t owe them any money until you process their invoice. A system of un-invoiced receives ensures that your supplier’s account and outstanding invoices always balance.

What happens in the general ledger for receives and invoices?

Below is the accounting detail of what really happens during a Goods Receive and Supplier invoice.

When a Receive is processed (Accounts payable > Receive):

Debit: Stock or expense account (it will increase)

Credit: Un-invoiced receivings account (it will increase)

Amount: Ex tax value of the goods received

When the supplier’s invoice is received in part or in full:

Debit: Un-invoiced receivings account (it will decrease)

Credit: Supplier’s general ledger account (it will increase)

Amount: Ex-tax value of the goods invoiced (and therefore received)

Accentis Enterprise ensures that if the invoice value does not match the original value on the Purchase Order (and therefore, the value for which the goods were received into stock or expenses) the Receive is re-processed at the new, correct, ex-tax cost reflected on the supplier’s invoice.

Why you need to know about this

As part of your regular accounting-system house-keeping, you need to keep track of un-invoiced receives to ensure that everything has been properly accounted-for. By monitoring your un-invoiced receives, you will be able to determine whether or not you have:

- Been under-invoiced or not invoiced at all for goods received

- Sent goods back to a supplier and have not yet received a credit

- Been over-invoiced for goods received

- Entered an invoice incorrectly against the wrong Receive (and therefore the incorrect Purchase Order)

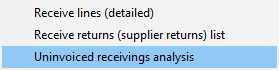

Each week, you should run your un-invoiced receivings analysis report (Accounts payable > Report > Receive > Uninvoiced receivings analysis (SA2432)) and verify that each of the entries is valid and has not been overlooked by you or your supplier.

“Cleaning up” your un-invoiced receives

Your un-invoiced receives report may show you records that should not exist, are incorrect or need to be adjusted in some way, and there are many reasons why an entry appears on this report. Legitimate entries will indicate that you have not been fully invoiced for goods or services that you have received, but the following list outlines other scenarios where data can be cleaned.

If you never get billed for the goods, then you should still enter an invoice as if you were billed and then enter a credit for the equal value. This has the effect of ensuring that the goods or services enter your system at a market price and that the credit can be accurately reflected into a bad debts or similar general ledger account

The credit that you enter can be on the same invoice as a separate line, bringing the total invoice value back to zero, or it can be entered as a completely separate credit invoice.

If you didn’t actually receive any goods form the supplier, then the original Goods Receive should be deleted or adjusted accordingly so that your system reflects the correct information. Once this is done, there should be no further run-invoiced receive.

If you can’t reverse the transaction because there is insufficient stock left, then if you actually did not receive the goods then your stock levels are clearly out and additional stock must be adjusted in to reverse the incorrect goods receive.

If you returned the goods, then you should reflect this with a Receive Return. This is preferable to deleting the original receive because it reflects and records what actually happened. Both the receive and the return should be invoiced as if you had actually received the paperwork

If you expect a credit for returned goods, then this is a legitimate over-invoiced receive and should remain in the report until the credit is received. This is your reminder that you are expecting a credit for goods returned.

If you have accepted that you will not be getting a credit from the supplier for goods that you have returned to them, then you should:

- Enter an invoice against the Receive Return

- Add a manual line to the invoice to offset the credit and allocate this to an appropriate general ledger account

The effect of this is to fully invoice the Receive, but still generate a $0 invoice for the supplier. At the same time, the manual line represents the loss you have incurred by returning items from your stock/expenses but not getting the credit.

If you have received an invoice but the invoice was entered manually and NOT against the Goods Receive, then you should delete the manually-entered invoice and create a new invoice from the Goods Receive record.

If a payment has already been made against the invoice then remove the invoice from the payment and add the new invoice of the same value before deleting the incorrect invoice.

Last edit 15/10/19