Preparing for your first pay run

It is important to set up correctly to ensure you:

- Pay correctly

- Report correctly

- Allocate costs correctly into your G/L

Some settings affect the way G/L postings and ATO reporting are done, and are difficult to change once you have started using the system so best to get right now.

It is also important to do a test pay run before performing the real one. If possible, match up with your old system to ensure that the same results are achieved.

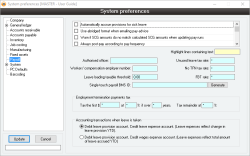

The Preferences user guide will help you to understand any fields that you are unsure of.

* These values can / will change from year to year.

It is difficult to change pay run postings once a pay run has been applied.

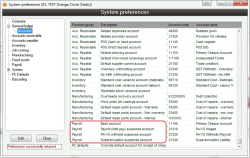

The following accounts under System > Preferences > General ledger > Accounts should be double-checked:

- Bank account:

This is the account form which wages will be drawn - Suspense account:

This is a clearing account and must always end up being $0. When a pay run is applied, wages are DEBITED to this account and then employee payments are CREDITED out. - PAYG withheld:

This is your ATO PAYG liability account. This account increases when you apply pay runs, and decreases when you remit your PAYG through your BAS. - Superannuation suspense:

This is your superannuation liability account. This account increases as you apply the pay runs, and decreases when you remit your superannuation

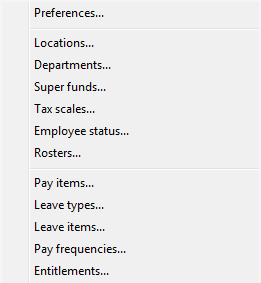

You are able to do this by going through the Payroll > Setup menu and working your way down one by one

Pay particular attention to:

- Departments:

Check that you have correctly set up ALL general ledger accounts for all departments. Once you have applied pay runs it is difficult to change these postings.

If you are not sure what the “Timesheet labour recovery” accounts should be, please contact Accentis support - Tax scales:

Ensure the tax scales are up to date (you will be warned if they aren’t). The “Effective to” date must not have expired - Pay frequencies:

Ensure that your pay frequency “Period end date” is set up correctly. This date must be the last day of a pay period (not the day staff get paid, but the last actual day of that pay cycle). It doesn’t matter if the date is in the past or the future, as long as Accentis knows what day of the week/fortnight/month it refers to.

Pay particular attention to the following items. Anything else can be modified after the pay run if required.

Superannuation tab

- Make sure that a super fund has been defined for each employee. If you don’t know their fund, then create a fund such as <unknown> so that at least they can begin accruing superannuation – you can change the fund later.

- Ensure that the super rate and thresholds are correct – especially the lower threshold – this should not be $0.

Pay details tab

- Check that the Pay frequency and Tax scale are both correct. You can also set the Last pay date now, but if you have many employees, it can be set in one easy command (shown later).

- If you are not certain, you should also check whether pay advice is emailed/printed

Pay items tab

- Only for convenience, ensure that you have all of the pay items that you require so that you don’t need to add them each time you do a pay run for each employee

Leave items tab

- Ensure that you have leave accruing for each employee as applicable. For any employee who accrues leave, the leave item must be listed and ticked

- Ensure that OPENING LEAVE balances have been entered or imported. This is very important as each subsequent pay run will record the opening balance of leave at the time of the pay run

Pay methods tab

- Ensure that you have at least one pay method. You won’t be able to apply a pay run without specifying a pay method for each employee

If you want to automatically transfer payroll data from the Accentis timesheets, then you must ensure the following have been set up for each employee who will be auto-transferring:

- On the Other tab, set:

- Auto transfer timesheet entries to pay run

- On the Pay item tab:

- Ensure that any pay item that you want to allow the employee to have recorded on their timesheet is set in the “TS” column (right click on the pay item to set)

- Ensure that ONE item is set as the default pay item for timesheets (it will have “Y+” in the TS column = right click on the pay item to set)

- Ensure that if you are using Labour Cost Recovery (link to document) then you have set your employee job cost rates appropriately

- Ensure that all of these settings have been put in place BEFORE timesheet entries have been made for this pay run. If not, the timesheet will not have store the correct pay items or rates

The final step, if it has not already been done individually, is to set the last pay date for employees do that on the first pay run, Accentis will be able to calculate the first day of this cycle (you may have started part-way through a cycle).

Run Payroll > Command > Update data for multiple employees (or press CTRL-SHIFT-R and type SA3981) > Select the employees (if all are on the same pay cycle, then you don’t need to select them) > Then enter the Last Pay Date. This will be the last day they were paid, or the day before their first pay run in your system

This is a critical step – you don’t want your very first *actual* pay run to be the first time you have tried this!

Do a test pay run first to satisfy yourself that you:

- Know what to do

- Have staff set up correctly.