End of year payroll processing

This document describes how to use the Accentis Enterprise payroll module functions to manage your end of financial year payroll processing.

This document is not a substitute for professional accounting and taxation advice and should not be used as a definitive guide to all of your payroll reporting and lodgment obligations.

Transitioning from another Payroll software to Accentis Enterprise and using STP: Read our guide on the options available to you when Transitioning from another payroll system with STP

This guide is slightly different if you are required to use Single Touch Payroll (STP) or not. Please select the appropriate section below.

Jump to How to process end of year payroll with STP instructions

If you are not using the Accentis Enterprise payroll system OR you are running the Accentis Enterprise payroll module outside of Australia, this document does not apply to you.

At the end of each financial year, there are some steps that need to be taken to finalise your payroll processing and reporting obligations to both your employees and the Australian Taxation Office.

As an employer you may have other obligations that you need to fulfil, but this document will show you how to perform the ones relating to Accentis Enterprise functions

By the 14th July each year you must lodge the STP finalisation for your employees. The STP finalisation reports the final year to date amounts paid to your employees, how much tax was deducted, and the amount of Superannuation calculated. Because year-to-date amounts are lodged through STP with each pay run, the ATO should have these figures already. The STP finalisation confirms the amounts reported are correct, or allows you to make adjustments if changes have been made, and set as "final" with no known additional changes to be made.

The end of year processing for payroll with STP must be done by July 14 (this is our current information but you must also check with the ATO in case there have been changes or your circumstances differ).

Because all data is sent to the ATO via STP, you no longer have to issue payment summaries. There is no reason why you can’t start preparing this as soon as you have completed your final pay run for the financial year.

It doesn’t take long – about 10 minutes if your data is nice and clean. If some of your employee data contains invalid postcodes, missing Tax File Numbers, etc., it will take longer.

Before performing any final end of year transactions, it is a good idea to run payroll reports reports and check that all of the payments that will be reported in your STP finalisation match with amounts in your payroll system and/or your General Ledger. This can help you identify incorrect payments allocation that can be adjusted prior to finalising your data with the ATO. The below 2 reports can be used to determine if everything is correct or if changes need to be made before the STP finalisation is processed.

SA1184 – Wages analysis by Employee / Pay item (Payroll > Report > Pay > Wages analysis by Employee / Pay item). This report shows all employees that have been paid for the period entered and allows you to double check the STP2 P/S column for the Payment type the Pay item has reported to the ATO.

SA1185 – Wages summary by Pay run / Employee (Payroll > Report > Pay > Wages analysis by Pay run / Employee). This report will show if there are any unapplied pay runs for the period and check the totals reported for your employees. This Report will also allow you to check that the amount of Superannuation calculated in the pay runs is correct with no +/- amounts showing.

There is no right or wrong way to do this checking – you are looking for anomalies or strange allocations that may have been made during the year that may identify where an incorrect pay item or amount has been entered on a pay run or reported through STP.

Last edit 29/04/24

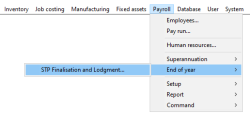

Open the Payroll > End of year > STP Finalisation and Lodgment function.

For more information on this form and the fields within it, see the user guide STP Finalisation and Lodgment.

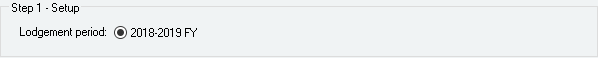

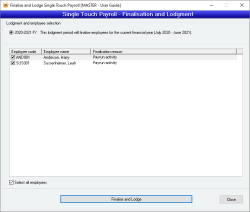

Select the Lodgment period. In most cases, this will be the most recent Financial Year. The finalisation date column will display the date of the last financial year the employee was finalised with STP, or 30/12/99, which indicates the employee has not been finalised with STP through your company yet. Once you complete this process for those employees requiring finalisation, the date will change to the end of the Financial Year that you are lodging.

Finalisation date: This column will always display a date. New employees or employees that have not been finalised with STP in a previous financial year will display the date of 30/12/99. Employees that have been finalised on a previous financial year will display that most recent date. The date for employees that you have selected to finalise and lodge will change to the most recent financial year once completed. Once you have lodged your STP finalisation, the date of finalisation will not change until a confirmation is received from the ATO. Submitting to the Transport Provider (Ozedi, MessageXchange, etc) will not change the date as they are only sending/receiving data to and from the ATO.

Select the employees that you want included in this finalisation. By default, Accentis will list all staff that have not had the finalisation completed for the Financial year selected and tick them to finalise. Untick any employees you want to exclude from the STP finalisation.

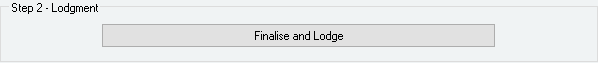

Once employees are selected, click on the Finalise and Lodge button. Only employees that are ticked will be finalised. The finalisation date will change for these employees only, and the employees not ticked will remain as they were.

This will display a confirmation box and declaration, and then a final submission.

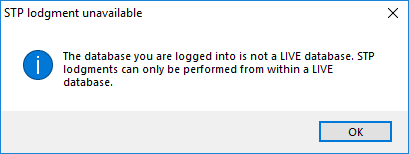

NOTE: You cannot submit STP lodgments if the database is not LIVE. If you need to lodge an STP finalisation for a prior Financial year, please contact [email protected] to help with the process.

That’s it! It is all done and on its way to the ATO just like your normal STP submissions each pay.

There is no need to print payment summaries or send any additional information to the ATO.

Employees who need finalisation and who will be shown in the STP finalisation screen are those employees who meet the following criteria:

- They are configured to report through STP because they do not have the Don't report this employee through STP option ticked.

- They have some kind of activity or information for the financial year being finalised, as follows:

- Pay run activity

The employee has been included on a pay run that is dated within the current financial year AND all of the following apply:- The Pay run date is AFTER the employee's current STP finalisation date (that is, activity has happened after they have already been finalised),

- One or more pay items on the pay run has a reportable payment summary position (that is, a payment summary position that is NOT “Other: non-reportable”),

- The value of one or more pay items on the pay run is not zero.

- Employee pay item opening values

The opening value of one of more pay items on the employee Pay Item list has a value that is not zero AND:- The employee's current STP finalisation date is BEFORE the start of the selected financial year (that is, they have not yet been finalised for this financial year),

- The pay item has a reportable payment summary position (that is, a payment summary position that is NOT “Other: non-reportable”).

- Reportable Employer Super Contributions (RESC)

Value has been included in the Reportable Superannuation field in the Pay run details (whether manually added or added automatically from the Superannuation tab on the employees form), AND:- The employee's current STP finalisation date is BEFORE the start of the selected financial year (that is, they have not yet been finalised for this financial year).

- Termination

The employee was terminated within the current financial year and the date terminated is AFTER the employee's current STP finalisation date (that is, they have not been finalised since being terminated)

- Pay run activity

Any payroll payments that you need to make are recorded on a cash basis. You generally must have physically made payments to/for employees before July 1 for them the payment to be included in the STP finalisation. Check with your accountant if you are unsure.

This includes things like:

- Additional salary sacrifice payments

- Bonuses

- Directors’ payments

- Any other payment that is to fall within this financial year

You don’t need to “roll over” the payroll module in Accentis Enterprise. When you roll over your entire system (which must be done within 3 months of the end of the financial year), your payroll module will be reset to current year figures as well. All employees’ leave accruals will remain as they were prior to the system roll over.

You should now be using STP to process your employee payments to the ATO. Because of this, Group Certificates no longer need to be sent to each individual employee. All the information is lodged through STP for each employee and handled through the ATO for that individual. Employees can access their payroll figures through their personal MyGov account at any time. Read more about Performing the End of Year payroll process.

Because you are using STP, most of the hard work has already been done for you. There’s only 2 steps that you need to take to process the end of year payroll:

- Check your data using STP reports (SA1184 and SA1185) and look for anomalies. Make any adjustments before sending the data to the ATO.

- Finalise and lodge your data to the ATO using the STP Finalisation and Lodgment form.

There’s no need to roll over payroll at the end of the year, it will be included when you roll the entire system over after the financial year.

The payroll end of year must be done by July 14th. This information may change by the ATO, which you can check here.

You need to inform the ATO of these changes by updating the employee data as required, or perform a new pay run and then lodge the pay run and re-finalise.

More information on making changes can be found on the ATO website here.

You can make the change in the correct financial year (pay run date). You will need to submit an update event to the ATO to make them aware of this change and then re-finalise the STP for the employee. If the change relates to prior financial years that have been rolled over, please contact [email protected] for details on how to process.

More information on making changes can be found on the ATO website here.

Finalisation means that you are telling the ATO the final figures for what you have paid employees for the financial year. When previously you would send the employee’s group certificates, you are now confirming the information that has been sent each pay run through STP.

Yes, you can. There are many reasons why you might need to finalise more than once, such as making amendments or updates.

Access the form through the menu Payroll > End of year > STP finalisation and lodgment. Read more about STP Finalisation and Lodgment form.

If you have selected the incorrect Financial Year when finalising employees, the following procedure can be used to rectify the situation:

- Go to Payroll > End of Year > STP Finalisation and Lodgment

- Select the Financial Year that you were supposed to select initially (not the current Financial Year)

- Determine which employees require finalisation for that financial year and manual select them in the employee list

- Finalise and Lodge

Once this has been completed, employees will be finalised the financial year and the correct finalisation date will be set.

Last edit 23/12/21