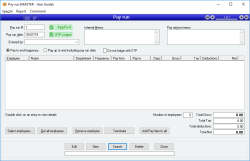

Pay run

A Pay run is the means by which employees are paid by the payroll system. A pay run can include one or more employees, and each employee can have a separate pay from and pay to date.

A pay run consists of a list of employees, each with their own lists of Pay items and Leave items specific to the pay run.

Once a pay run has been entered and employees have been selected for it, the pay run is then applied which performs all the necessary updating of employee and General ledger records for that pay run.

Employees may have a Protected status. These employees are only able to be seen and managed by Administrators. Without administrator permissions, you will be unable to:

- See protected employees in the employee list

- Process a pay run for protected employees

- View a pay run that contains protected employees

- View a payroll payment in A/P that contains protected employees

More information is available here for Employees.

- An unlimited number of employees can be selected for a pay run

- No practical limit to the number of Pay items or Leave items that can be specified per employee

- Duplicate Pay items can be added per employee

- Employees can be automatically added to a pay run only if required, based on their last pay date and their pay frequency

- A pay advice memo can be entered per employee as well as for all employees in the pay run

- QuickPay buttons allow instant addition or removal of one unit of pay of specific Pay items for an employee

- Automatic calculation of termination amounts including unused leave and tax on termination payments

- Electronic remittance supported

- The last pay run can be unapplied and edited if necessary

- Complete details of every pay run can be viewed at any time

- A pay run can be entered at any time and applied only when necessary

- Pay advice notification can be e-mailed to employees

- Automatic adjustment of leave liability amounts each pay run to support pay increases

- Employees don’t have to be paid according to their normal pay frequency

- Pay items entered for employee timesheet entries can be automatically included in pay runs

Module: Payroll

Category: Pay run

Activation: Main > Payroll > Pay run

Form style: Multiple instance, WYSIWYS, SODA

Special actions available for users with Administrator permissions:

- Alter the User ID in the Entered by field.

- Add Protected employees to a pay run.

- View and edit pay runs containing Protected employees.

- Change the User ID of the Entered by field of memos.

- Edit memos entered by other users.

Database rules:

- Only one unapplied pay run can exist at a time

Reference: number, read-only, WYSIWYS

This number uniquely identifies a pay run. The Pay run # is automatically generated by the system after the first update of a pay run and cannot be changed for the life of the pay run.

If a pay run is deleted, its Pay run # will never be used again for another pay run.

This field displays status icons such as Applied status and Single Touch Payroll status.

Reference: date, mandatory, QuickList, WYSIWYS

This is the date of the pay run which will be used for all General ledger transactions generated when the pay run is applied, and is therefore used during the allocation of wages and other payroll expenses / liabilities.

This field displays status icons such as Applied status and Single Touch Payroll status.

Reference: Read-only

Indicates whether the current pay run has been applied or not.

- The current pay run is applied

- The current pay run is applied

- The current pay run is yet to be applied

- The current pay run is yet to be applied

For more information on applying a pay run, see the Apply / Unapply pay run field.

Reference: Read-only

Indicates the Single touch payroll lodgment status of the current pay run. Clicking the icon will either display details of the STP lodgment (If done) or lodge the record (If not already lodged).

- A Single touch payroll lodgment has not been performed for the current pay run. Clicking on the icon will perform the lodgment.

- A Single touch payroll lodgment has not been performed for the current pay run. Clicking on the icon will perform the lodgment.

- A Single touch payroll lodgment has been performed, but a response has not yet been received from the ATO. Clicking on the icon will display SA4422 - STP Dashboard with details of the lodgment.

- A Single touch payroll lodgment has been performed, but a response has not yet been received from the ATO. Clicking on the icon will display SA4422 - STP Dashboard with details of the lodgment.

- A Single touch payroll lodgment has been performed and was accepted by the ATO. Clicking on the icon will display SA4422 - STP Dashboard with details of the lodgment.

- A Single touch payroll lodgment has been performed and was accepted by the ATO. Clicking on the icon will display SA4422 - STP Dashboard with details of the lodgment.

- A Single touch payroll lodgment has been performed but contained errors which should be checked. Clicking on the icon will display SA4422 - STP Dashboard with details of the lodgment.

- A Single touch payroll lodgment has been performed but contained errors which should be checked. Clicking on the icon will display SA4422 - STP Dashboard with details of the lodgment.

For more information on Single Touch Payroll lodgments, see Single Touch Payroll (STP)

Reference: select from list, mandatory, HotEdit, WYSIWYS

This is the User name (not user login ID) of the user that entered the pay run. This field is automatically filled in with the user name of the current user and can only be changed if the current user has administrator permissions.

Reference: Yes/no

This button specifies that the default Pay to date for the selected employees is set to last normal pay day (based on their pay frequency) before the pay run date. If the employee is not due to be paid under these conditions before the specified pay run date, they will not be included in the list.

Using this option means that you can enter a pay run at any time on or after the normal pay day and selected employees will still only be paid up to the their last usual pay day before the pay run date.

Once employees have been added to a pay run, their Pay to date for the pay run can be manually modified.

Reference: Yes/no

This option specifies that the default Pay to date for selected employees should be the same as the pay run date for the pay run.

Once employees have been added to a pay run, their Pay to date for the pay run can be manually modified.

Reference: Yes/no

If this field is set, it will not prompt for STP lodgment when applying the pay run.

Reference: memo, expandable

This is an internal memo used only for reference purposes for the pay run.

Reference: memo, expandable

This is additional information that is appended to the pay advice for each employee in the pay run. This field is optional.

This is the list of employees that are being paid in the current pay run. The columns are as follows:

- Employee(Text, WYSIWYS): The employee code

- Name: The employee last name and given names

- Department: The department assigned to the employee

- Frequency: The pay frequency for the employee

- Pay From: The date immediately after the most recent Pay to date for the employee. If the employee has never been paid, this will be set to their date started.

- Pay To: The date up to which the employee is being paid (inclusive)

- Days: Number of days to be paid

- Gross: The pre-tax income of the employee. Note that this is not necessarily the same as the taxable income for an employee: only certain amounts from an employee's gross income are considered taxable.

- Tax: The amount of tax for the employee

- Deductions: Total amount to be deducted

- Net: The net amount paid to the employee

From this list you are able to terminate an employee. To do that, right-click the employee and select Terminate employee.

Several icons may also appear before an employee in the list. These icons represent a quick, visual way of indicating interesting facts relating to the employee for this pay run.

- Sick leave has been included for this employee.

- Annual leave has been included for this employee.

- The employee has been terminated on this pay run.

- The employee has a pay advice memo for this pay run.

Reference: button

This displays the Employee QuickList from which you can select one or more employees to add to the pay run.

If any employee you select has already been paid for the entire pay run period, you will be shown a message indicating that the employee does not need to be paid and asked if you still wish to add the employee. Once employees have been added, pay run figures for the employees will be automatically calculated based on the last pay date for the employee and the date specified for the pay run.

You cannot add an employee more than once to the list of employees.

Reference: button

This button automatically selects all employees and adds them to the pay run. If any employee has already been paid for the entire pay run period, you will be shown a message indicating that the employee does not need to be paid and asked if you still wish to add the employee. Once employees have been added, pay run figures for the employees will be automatically calculated based on the last pay date for the employee and the date specified for the pay run.

Reference: button

This removes the currently-selected employee from the list of employees for the pay run.

Reference: button

This button will open the Terminate employee form, which can also be accessed by right-clicking on the employee and selecting Terminate employee.

Last edit 29/01/20

Reference: button

This button displays a quicklist as with adding a pay item to a single employee. It will perform the add process for all employees in the pay run at the time.

Reference: currency, read-only

These totals show the total amounts for all employees listed for the pay run as follows:

- Total Gross: The total pre-taxed amount for all employees

- Total Tax: The total amount of tax paid by all employees

- Total Deductions: The total amount of deductions paid by all employees

- Total Net: The net amount paid to all employees (Gross – Tax)

Reference: Special menu

This menu option applies or unapplies the current pay run.

When a pay run is applied, all the entitlements for each employee are updated and Payment records are generated for each payment method specified for each employee. Once a pay run is applied, it cannot be deleted or modified in any way.

When a pay run is unapplied, all the effects of applying the pay run are reversed. This includes all automatically generated Payment records and therefore all related remittance information. You will be warned of this when you attempt to unapply a pay run.

Only the last pay run can be unapplied — that is, the pay run with the highest Pay run #.

Reference: menu

This action will display a print/email window in readiness to print or email pay advice to the employees that have been selected (using CTRL-click or SHIFT-click). By default the box will be set with an output type as <auto> and the action to print or email will be determined by the setting in the employee’s file “Employees” or “Pay advice is printed ”.

This option will not perform any action until you click the Run button on the next screen, and you also have an opportunity to see the list of employees who will be emailed or printed.

Reference: menu

This action will display a print/email window in readiness to print or email pay advice to all employees on the pay run. The default the box will be set with an output type as <auto> and the action to print or email will be determined by the setting in the employee’s file “Pay advice is emailed ” or “Pay advice is printed ”.

This option will not perform any action until you click the Run button on the next screen, and you also have an opportunity to see the list of employees who will be emailed or printed.

Reference: Menu

Lodges Single Touch Payroll data for all employees on the selected pay run.

Only users with Add permissions on the Single touch payroll function are able to use this menu item.

Last edit: 25/06/22